The cost price is a key element in managing a company. Whether it is an industrial SME, a trading activity or a service company, everyone has an interest in knowing their cost prices. But what exactly is it ?

The cost price (sometimes called cost price) brings together all the costs incurred by a company for a unit of product or service sold. To simplify, this is the whole of what your product or service costs you.

Better monitoring thanks to cost price

Since the cost price collects all the costs of your product, we can therefore say that the selling price minus your cost price gives you your gross margin.

So you can use this indicator to set your selling prices. You know that your minimum selling price to cover all of your costs will be equal to your cost price. You don’t have to go below that price if you don’t want to be in a loss. So you can better manage your pricing offerand decide whether or not you can accept a deal at a given price.

Of course, knowing its cost price will allow you to understand and then act on its composition by seeking to optimize it. You will be able to reflect on the usefulness of a particular cost and reduce certain costs. For example, by taking another supplier at lower rates.

With the cost price, determine your selling prices according to the performance of your company and more solely based on the price of your competitors.

You will also have a better understanding of all your activities. After you’ve got your cost price, you’ll better visualize all the essential steps in the production of your products or services. You will also be able to analyze the profitability of each of your activities. You may decide to refocus your business by abandoning a product that would not be profitable.

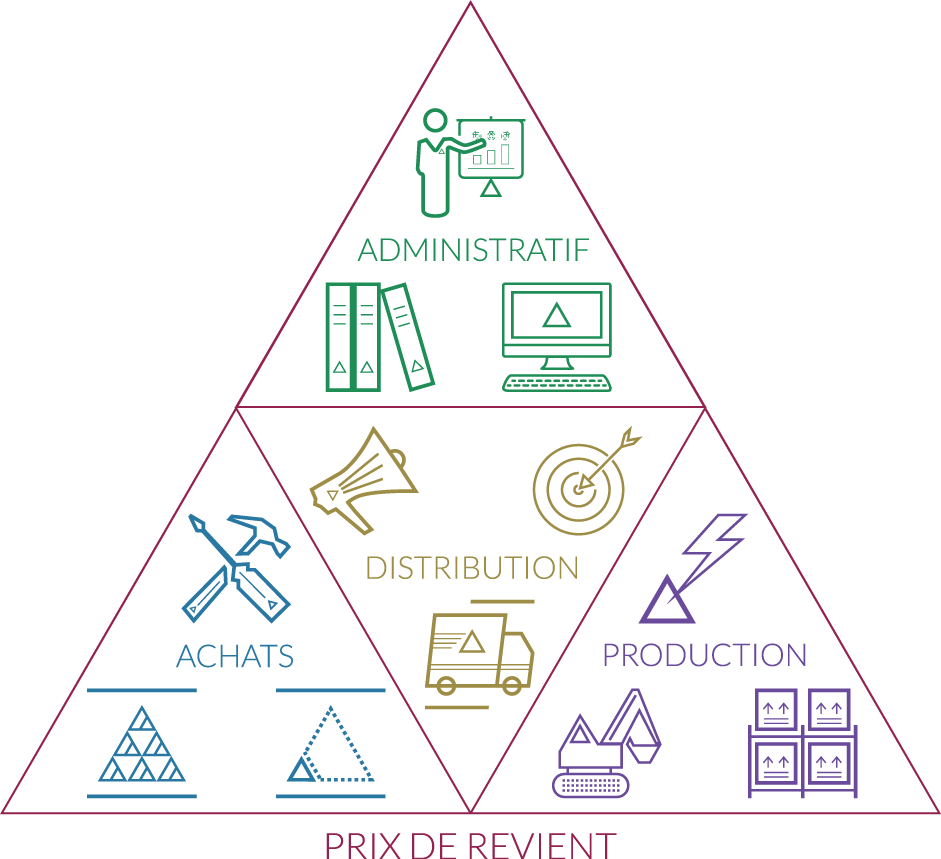

The distribution of the expenses

As mentioned earlier, we will have to collect all the costs incurred by the company to get our cost price. So you’ll have:

- purchase costs: goods, raw materials, consumables, …

- production costs: labour, energy, machinery costs, etc.

- distribution costs: advertising, sellers’ salaries, delivery, etc.

- administrative costs: HR, accounting, IT, etc.

But how do you allocate all these burdens among the different products ? There is a distinction to be made between direct and indirect charges.

Direct expenses are those that can be directly assigned to an activity. For example, buying the raw material of a product or the wages of workers on your production line. Indirect expenses are those that will have to be spread over several activities. For example, the salary of the company’s executive or the cost of your IT department.

The difficulty lies in the distribution of these indirect expenses. You will have to look for distribution keys that are consistent and that best reflect the consumption of expenses by your activities. For example, your storage site’s rent may be distributed among your different products based on the space used by each product in your warehouse.

Keep it simple and understandable when choosing your allocation keys, accuracy is not always the best option.

The choice of these distribution keys can be debated within the company. Take the example of electricity : should this expense be distributed according to the space used by each activity or according to the energy power of the machines used ? There is no standard model, each company will have its own method of allocating indirect expenses.

Activities at cost price

In order to refine your cost analysis, it is worth breaking your organization into activities. These are the basic tasks performed by the various departments of your company. To help you, look for anything that can be described by a verb, a supplement and a name: Prepare a package, weld a piece, sell a product. Depending on your level of maturity, you will be able to more or less refine your activities. A start-up will start with a global sales activity. But a more mature company will break down this same activity into 3: prospecting, quotes, sales.

One of your activities unbalances your entire company ? Consider other scenarios such as outsourcing, for example. You can also stop this activity but think about your fixed expenses and your break-even point.

After determining all your activities, you will have a clear representation of the organization of your company. Then assign your expenses to your activities. Then, assign your business to your products or services sold. This gives you a detailed representation of all the processes that allow the sale of a particular product. But best of all, you are now able to identify the weight of each activity in the cost price of a product.

The cost price is therefore a great indicator to adjust your selling pricesand act on the costs of your products. However, getting the cost price can be time-consuming for some companies. Using an online tool such as Perfactor allows you to simplify this process and quickly come up with analytics data that allows you to control your company’s performance.