Whether you’re a business leader or founder, knowing your break-even point is crucial to monitor your business. Let’s discover together this indicator and its usefulness for your business.

The break-even analysis

The break-even point is the level of turnover to be achieved to cover all of your fixed and variable expenses. So that’s the amount of turnover from which you start making a profit. As long as you’re below that threshold, you’re losing. So when you reach your break-even point, your bottom line is zero : your sales cover exactly all of your expenses.

We have just mentioned two concepts that deserve further study: fixed and variable expenses.

Fixed expenses

This is the set of loads you have to bear even when your turnover is zero. For example, rents, wages, subscriptions, etc.

It is often tempted to say that these expenses do not evolve according to the activity of the company, hence the term fixed expenses. That is not entirely accurate. These expenses will evolve according to your turnover but in successive stages. Let’s imagine the wages of your salespeople. From a certain level of growth, you will be forced to hire a new salesperson because your current team will be at its maximum capacity. Your fixed expenses will therefore increase at once, you will move to the top level.

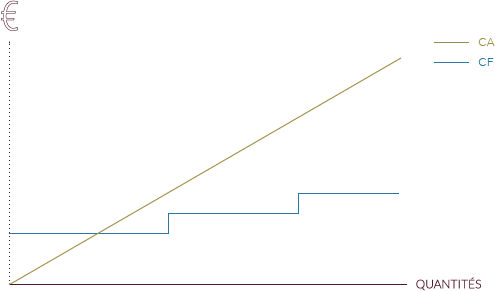

If we represent these expenses as a curve, we get this :

Variable expenses

This is the set of expenses that are directly related to your turnover level. For example, delivery costs, purchases of raw materials or goods, packaging, etc. These expenses will therefore change according to the sales achieved.

Sometimes it can be difficult to identify whether the expenses are variable or fixed. We were talking about wages in the fixed part. But some of the wages can also be a variable burden. This is the case when you pay turnover-related bonuses or when commissioning sales.

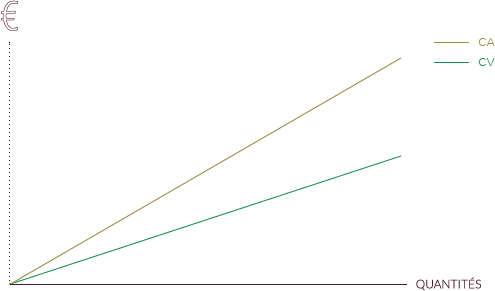

If you represent these expenses in a simplified way on a curve, here is the result :

The break-even point

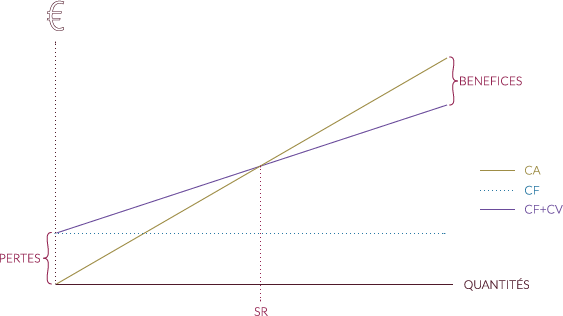

The break-even point will be reached when the turnover is equal to the sum of fixed and variable expenses.

So here is the simplified graphic representation with expenses and turnover.

Goals, strategy, financing : the usefulness of the break-even point

Whether it’s in the creation phase or for the launch of a new product or just for the monitoring of the activity, the break-even point offers crucial information for the management of your business.

Set your goals

When you know your break-even point, you know the level of turnover you need to achieve to start making a profit. This will allow you to determine your sales goals based on this data. You can check out the instructive article on the turnover to find out more.

Without this information, you navigate on sight or rely on your intuition. With this indicator, you can act faster when you find that you are slow to reach your break-even point You no longer have to wait until the end of the fiscal year to find out if you have made a profit. By tracking your turnover, you will be able to determine if and when your break-even point will be reached. This allows you to react and take corrective action, whether on yours selling price or on your costs.

Adapt your strategy

When you find that your level of activity is not enough to break even, it may be wise to stop this activity that is undermining your economic performance. An activity that stays below the break-even point generates no profit and only increases your expenses.

Stopping the activity is sometimes not the right option, before making this decision, think about deferring fixed costs on the rest of your business. A product may not be profitable but can still absorb some of your fixed expenses. Without it, your other products may lose profitability or even become loss-making.

Before starting a new business, determine its break-even point. If you find it difficult to reach, re-examine your launch. Look for a solution by working for example on your costs or abandon the project.

Get funding

The break-even is an indicator to include in yourbusiness plan.Thanks to him, your banker or your investors will visualize the level of activity you need to achieve to generate profits. An easily attainable threshold will reassure your financial partner about your ability to repay your debt or pay dividends.

Your partners will also be able to track your results during the year and know the remaining turnover to be achieved before reaching this threshold. It’s a great way to reassure your financial partnersabout your company’s economic performance.

Calculate your break-even point

Your break-even point can be expressed in three ways: in terms of turnover, in the number of units for sale or in terms of duration before being profitable (then called a dead end).

The turnover level

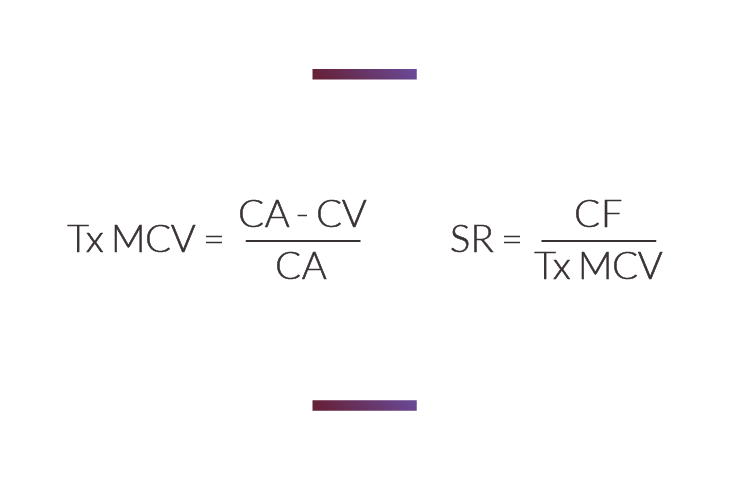

In order to get the break-even point (BEP), the variable cost margin (VCM) must first be calculated. This is the difference between your sales and your variable expenses. Then translate this margin into CVD rates on your turnover.

Finally, divide your fixed expenses by your CVD rate to get your break-even point.

Let’s take an example. A company expects 100,000 euros in sales over the year. Its fixed expenses are 40,000 euros and its estimated variable expenses are 30,000 euros. Its CVD is 70,000 euros (100,000 – 30,000) or 70%. Its break-even point is 57,143 euros (40,000/ 0.7). This company must make a minimum turnover of 57,143 euros before making a profit. It is also possible to obtain the SR from the average unit selling price. In our example, the average selling price is 10 euros and the variable unit costs are 3 euros. We’re getting the same result.

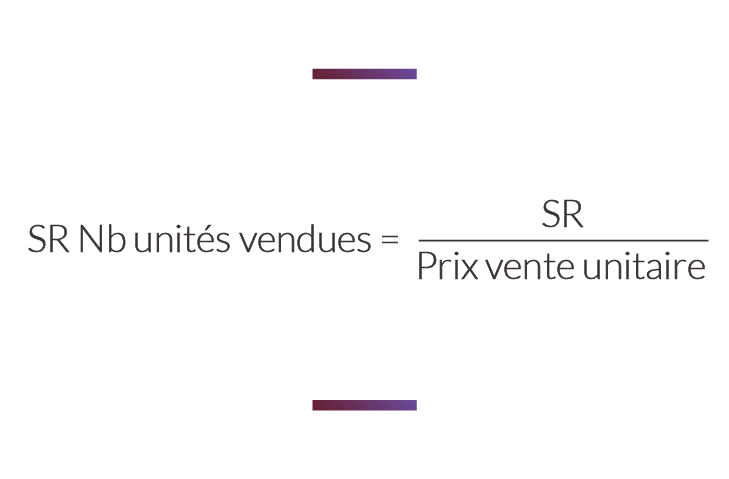

The number of units sold

It is possible to achieve its break-even point no longer by amounting to turnover but by number of units sold. For this, just divide the SR obtained above by the average unit selling price.

In our example, 57 143€ / 10€ = 5 714. The company will have to sell 5,714 units to cover all of its expenses

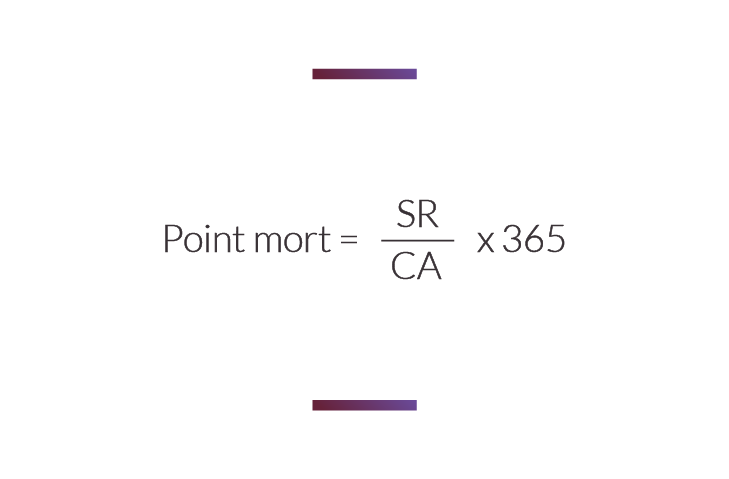

The number of days

You can also express its break-even point in number of daysbefore becoming a beneficiary. This is called a dead end. It represents the number of days it takes you to break even. To obtain it, we divide our SR by the turnover and multiply it by 365.

In our example, (57 143 / 100 000) * 365 = 209. The company will therefore be profitable from the 209th day of activity.

Lowering its break-even point : varying costs and optimizing fixed costs

By lowering your break-even point, you need less sales to become profitable. You cover your fixed and variable expenses more quickly.

The lower your break-even point, the more quickly you can minimize your risk of exploitation.

Variabilise costs

Analyze your fixed expenses and see if some costs can’t become variable. For example, by subcontracting a particular area to external providers. In this case, you turn a fixed expense into a variable expense that evolves according to your needs. We can outsource part of the production but also outsource certain intellectual services.

Optimize your fixed costs

As with your variable expenses, think about the usefulness of all your fixed expenses. Is it possible to reduce or remove some of them ? Do you need such a large building ? Is your fleet really needed ? Rather than having a shop, is it possible to sell online ? Question each position and optimize it.

As you can see, the break-even point is an important indicator in the management of your business, whether upstream, for the launch of a product or the creation of a company, or during the business, for better decision-making and better monitoring of your performance.