Solvency : your ability to pay off your debts

Analyzing the solvency of a company results in studying its ability to to pay its debts in a timely manner. Will it be able to meet all of its financial commitments ? To do this, we distinguishe long-term solvency from short-term solvency, more commonly known as liquidity.

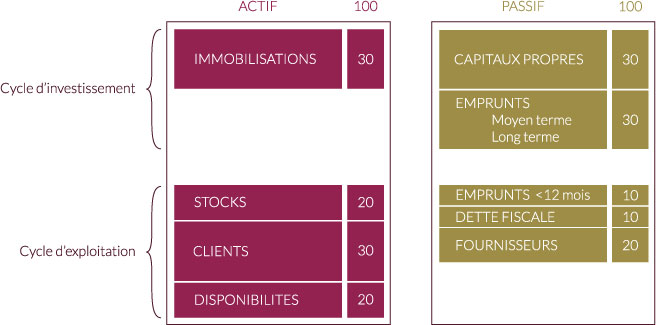

To fully understand the different concepts, you must look at a company’s balance sheet and study its components. In the simplified representation below, you have an overview of the composition of a company’s balance sheet that can be separated into two: the investment cycle or top balance sheet centered on the long-term, and the operating cycle low balance sheet centered on the short term.

Solvency

For debts payable within more than one year, we will check whether the sale of your company’s assets, i.e. machines, buildings, stocks or invoices customers awaiting settlement, will be able to repay all of your debts. If this is the case, the company is solvent. Otherwise, your creditors will not be able to recover all the money they are owed. Your business is insolvent et represents a risk for your partners.

In our example, the company has a ratio of 100/70, or 1.43. The company is considered as solvent because its assets are greater than its debts.

Just because you’re solvent doesn’t mean you’ll be able to easily pay off the debts of the coming weeks.

This fairly basic ratio seeks to show whether the company could pay all of its debts by selling all of its assets. This ratio must be accompanied by liquidity ratios to be consistent. Just because you’re solvent doesn’t mean your short-term financial situation is healthy. Even if you have buildings and equipment worth 30K euros, you can’t pay your bill from a supplier at the end of the month with that money locked into your business. To study the ability to meet short-term maturities, liquidity needs to be addressed.

Liquidity

If we focus on the short term, we will measure the ability of your company’s assets to become liquid based on the maturities you face. Becoming liquid here means turning into cash available immediately by your company. A building will not bring as easily cash as an unpaid serious customer’s bill. If your business does not have assets liquid enough to finance the maturities of the coming weeks or months, you will be in financial difficulty and you may run out of cash.

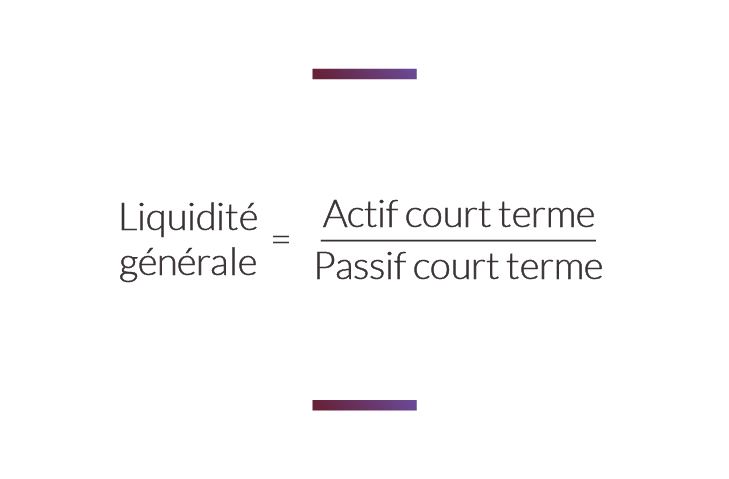

This ratio measures the overall liquidity of the company. Can you pay your maturities within one year by selling your assets for less than one year ? A minimum ratio of 1 indicates that you can meet your debts in the coming weeks or months.

In our example, the company would have a ratio of 70/40 or 1.75. Its assets that have less than one year manage to finance all maturities within one year.

However, it is possible to be even finer in the analysis.

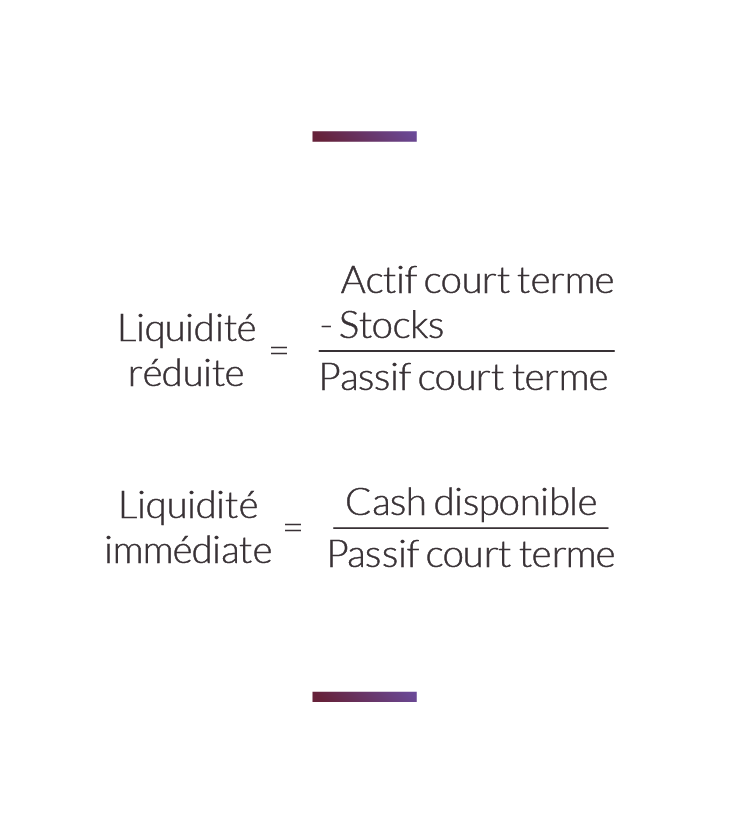

The first ratio above removes stocks from your resources. Your stocks may depreciate and lose value (we talked about it in our inventory management article). They can also sometimes be difficult to sell (fashion effects, seasonality, …). By taking them out of your short-term resources, you are stricter, more demanding in your definition of liquidity.

Here, our company would have a ratio of 50/40 or 1.25. Even without the stocks, the company remains able to meet its maturities for less than a year.

The second ratio only takes into account immediate liquidity, i.e. cash directly available in your business. In our example, the company’s cash alone cannot cover the debts for less than one year: 20/40 – 0.5.

The link with the BFR

Solvency and liquidity are two concepts related to the BFR and FR described in our previous article. The operating cycle most often generates a need for cash that is filled in whole or in part by working capital. The difference between FR and BFR represents your free cash. Check out our article on the BFR to learn more.

Determine the possibility of getting a loan by studying your creditworthiness

Determining the solvency of a company is interesting as a partner to assess potential risks on outstanding or future debts. But what is the point of measuring the solvency of your company ? Simply to determine your debt potential. Are you in a position to go into debt ? Can you get a loan from your bank given your company’s current financial situation ?

By taking out a loan, the company can finance its business and invest to grow and grow. It’s called financial leverage. By injecting cash into your company, you unlock access to certain markets, you invest in more profitable and efficient equipment, you develop new products. This loan will ultimately earn you much more than its original value. That is the financial leverage.

Your solvency ratios will determine your ability to obtain financing but will also determine the bank’s interest rate.

However, there’s a limit to your debt. From a certain level, you will no longer be able to cope with repayments and your maturities. If your business declines, you’ll be in too risky or even on the verge of failure. Measuring your creditworthiness will allow you to determine how far you can go into debt without risking being in a difficult position. For this, we will use several ratios.

Debts capacity analysis ratios

Find out if you can take out a loan with these few ratios.

The financial self-sufficiency ratio

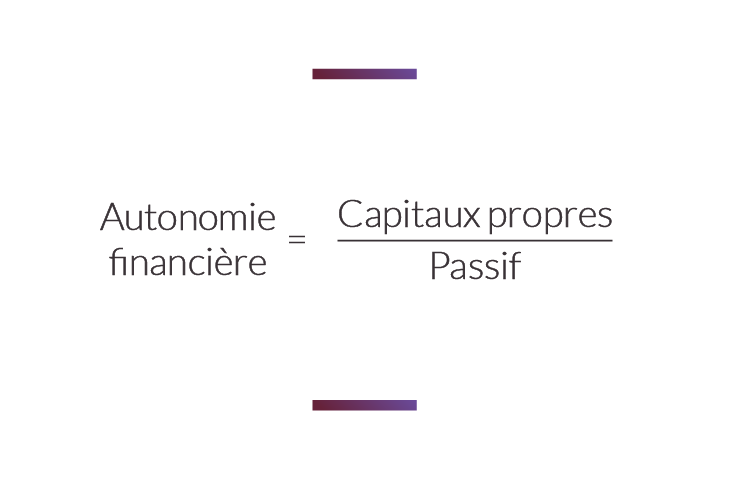

This ratio will allow you to know the weight of your equity in all of your debts.

Equity is capital brought into the company by owners or shareholders. This capital must represent at least 20% of all your debts in order to have a reasonable autonomy. The lower your ratio, the more it means you need external partners to finance your business. Try to maintain your financial independence above 30% ideally and don’t go below 20%.

Our fictitious company has a ratio of 30%. This means that its shareholders are 30% involved in financing the company.

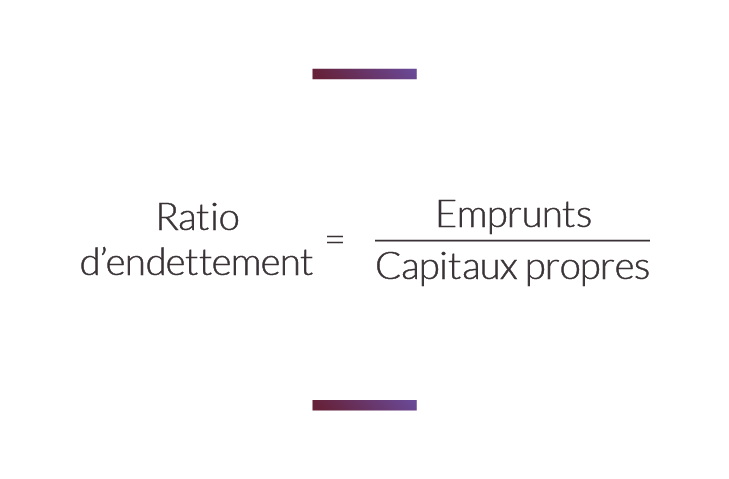

The debt ratio

This ratio is used to determine the level of your debts relative to your equity.

The higher the ratio, the higher your debt, resulting in high repayments that, if they are too large, could harm your financial health if your business is weak. However, too low a ratio can reveal too cautious management of your business: you don’t take advantage of all the opportunities to grow your company. This can be detrimental in a highly competitive market and eventually reduce your market share. In our example, the company has a ratio of 40/30 or 1.33. The sum of its loans is greater than its equity. A ratio of less than 1 is considered to mean that the company can still borrow. Beyond that, the situation becomes more delicate. However, this rule needs to be adapted to suit the industry. Banks will use this ratio to determine your debt level and whether you can still meet new financial commitments without the risk of default. With all this information, you can tailor your strategy to suit your financial health and performance goals. By focusing on long-term financing, you reduce your liquidity risks but get a low return on your equity. By promoting short-term financing, you get superior results but increase your risk. It will then be a matter of finding a certain balance.