The level of cashis now a priority indicator to manage its activity. Many companies report cash flow problems.

In 2016, three-fourth of SMEs and ETIs considered their bank cash level indicator a priority for the management of their business and 27% had already experienced a cash problem within a year. (source).

This is even the 2ndreason for failure if we turn to the side of start-ups.

After the lack of market need, the second reason for failure of start-ups is the lack of cash (source).

Hence the importance of planning your cash needs to manage your business serenely.

From the moment the company is created, a well-realized cash plan will benefit you and give you visibility on your financing needs. This will also reassure your banking partners as well as your investors, such as in the context of a fundraiser.

In times of growth, it is normal to increase your expenses but how to know how far to go if you do not follow the cash of your company. Without a cash management tool, you can only base your decisions on intuitions. The cash flow plan will provide you with reliable and tangible data to increase your chances of long-term success.

Cash receipts and disbursements : the cash plan in detail

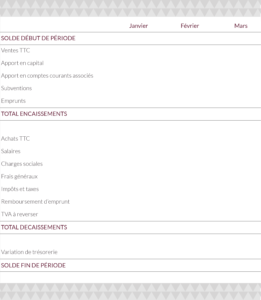

The essential tool to manage your cash is the cash plan. Not to be confused with the funding plan. In this cash plan, you will inform all the expected cash receipts and disbursements. We are talking about what goes into your bank account and what comes out of it.

In the form of a table, you will group your sales and financing:

- TTC turnover

- Capital contributions

- Subventions

- Bank loan

The difficulty here lies mainly in the forecasting of the turnover. Make realistic forecasts that you will adjust during the year if necessary. Don’t get overly optimistic about your turnover at the risk of totally skewing your cash flow plan. Once you have your sales, apply them the appropriate payment period. If you know your customers are paying you 30 days at the end of the month, be sure to include this lag in your cash flow.

Then your expenses :

- Purchases

- Wages

- Social expenses

- Taxes

- VAT to be paid

- Rent

- Loan repayments

When your company already has one or more years of seniority, use the previous year to make your forecasts correlate with your forecast turnover. On the other hand, it will be more complicated for a start-up or in a situation of hyper growth. You will then have to estimate your expenses as best as possible, again taking into account the payment times and the periodicity of payment of taxes, taxes and payroll taxes.

Our tips for your cash management

Count your forecasts on the date your cash is in and out

This is the important point to consider in this cash plan. Your forecasts will be different from your accounting because a billed sale may very well remain unpaid. It is crucial to incorporate payment times into your cash management or you may find yourself in difficulty paying.

Incorporate the VTA

When you pay a bill, you pay VAT. Ditto when you sell a product or service, your customers pay you the VAT. So you need to give your TTC figures. On the other hand, add a special line for the payment of VAT that you will make to the tax administration. The goal is to still have a realistic view of your banking movements.

Monitor your customers’ payment times

Try to minimize your customers’ payment times. It is better for a customer who pays 100 euros today than another who pays 110 euros in 45 days. This is important to anticipate the cash fluctuations that can occur between your purchases and your sales.

Watch for any late payments or refusal to pay and don’t hesitate to relaunch your customers. If you don’t lobby for your bills, you’ll often be the last one to pay.

In the event of a big difference between the customer payment time and the supplier payment time, it may be appropriate to opt for a factoring service that will help you optimize the management of your cash.