If there is one indicator that financial analysts and bankers like to ask companies, it is the Need for Rolling Funds (BFR). You will often hear from a consultant advising you to manage your BFR. We will describe this indicator that may seem difficult to grasp and show how to best master this famous BFR within your company.

The BFR, an indicator of your short-term cash need

The need for working capital is concerned with your operating cycle, your short-term business. Its purpose is to highlight the discrepancies that exist between your cash inflows and your cash outflows. Your BFR is generated by the difference between your supplier payment times and your customer payment times. It also takes into account your inventory runoff.

In a simplified world to the extreme, we buy the exact stock in the morning and then sell it in its entirety during the day. This generates us the cash needed to buy the next day’s stock. The reality is quite different, because we buy our stock which is gradually flowing and sales are made at a later date and also gradually in the long term. So, there is a gap between the money we spend to buy the stock, and the money we earn from the sale of our products. So, we’re talking about the need for cash to complete this perpetual cash movement called the « working capital requirement. ».

Let’s say you pay your suppliers at 30 days and your customers pay you at 45 days. You have a gap that creates a need for cash. You have to pay your suppliers when you have not yet cashed in the money from your sales. Add to this a large stock of goods and finished products and you make the situation even worse. Your stock represents locked-in cash, waiting in your business.

The calculation of the BFR

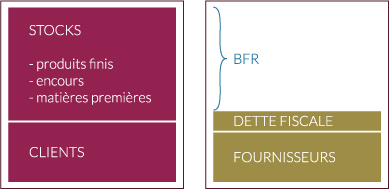

So, you have on one hand, cash that belongs to you but which has not yet been cashed in : the sales made which were not collected (We are talking here of operating receivables), the stocks present in your company.

And on the other hand, you have cash that doesn’t belong to you, which you’re going have to pay back : : unpaid purchases from suppliers, tax and social charges, short-term borrowing. It is the operating debts.

The difference between these two parts represents your BFR.

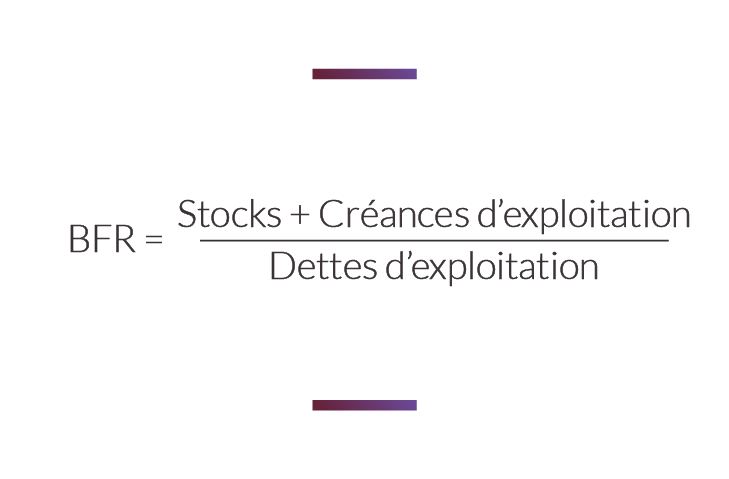

So we get this formula :

Your BFR may be negative. We are no longer talking about working capital requirements but working capital resources. This is the case when you pay your suppliers after you have cashed in the sales. The classic example is that of the supermarket which manages to negotiate very long settlement times for its purchases while sales are cashed on the same day.

In this situation, you generate a surplus of cash related to your business, your operating cycle.

A poorly controlled BFR can be costly

As we have seen, the BFR represents a necessary cash need for your day-to-day business. Not mastering this indicator can lead to significant financial implications that will harm the health of your company.

First, if your BFR is too large, you will suffer from high financial costs. You will have bank overdrafts that will result in agios. Or you will have to take out a short-term loan that will cost you interest.

When you extend payment times to suppliers, you miss the possibility of obtaining discounts, i.e. prepayment discounts. Earning between 1 and 5% of the total amount of your bill is not negligible.

The cash you are missing because of too much BFR could have been placed in a more favourable situation. That money would have brought you interests. With a poorly controlled BFR, it’s hard to consider placing some of your cash in remunerative accounts.

Avoid financial costs and reassure your partners by mastering your BFR.

In addition to the financial impact, you weaken your balance of power with your suppliers. When you extend your payment deadlines or even don’t meet the due dates, you lose the trust of your partners. It makes it difficult for you to negotiate rates on your purchases. You may even lose a quality supplier who wants to sever their business relationship with your company.

You may also lose the trust of your financial partners, of your banker who will see your BFR increase too much. Your employees may also have doubts about the health of your company and may eventually decide to work for another more financially reliable company.

It is therefore in your best interest to follow the evolution of your BFR and to master it. It is possible to track the evolution of the BFR through the following ratio :

Excluding structural changes, this indicator must be stable. It is the part of your turnover that you need to use to finance the cash needs due to your day-to-day business. If this ratio deteriorates, you can then take action to reduce your BFR.

Play on payment deadlines and your inventory to optimize your BFR

There are several ways to optimize your BFR. Some will have a financial cost, others will have an impact on your business strategy and your organization. It is important to strike a balance so as not to harm your financial health rather than improve it.

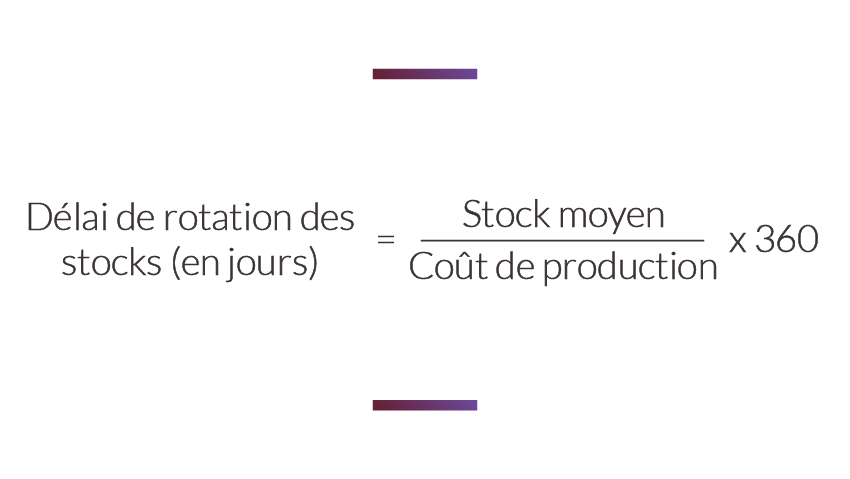

Reduce your inventory

We’ve already talked about it, the stock is a cash tank that’s tied up in your company. It will only bring you money in the bank once it is sold. For the duration of storage, you miss out on cash inflow.

It is possible to monitor its stock rotation time with the following ratio :

Be careful though, because by reducing your inventory, your delivery times may be more important to your customers. So you have to find the right balance so you don’t displease your customers.

Reduce your cash-in time

Make sure your customers pay you in a very short time. The shorter this time will be, the less your cash needs will be important. You can offer a year-round payment in advance with a discount. Also offer a discount based on the payment period to encourage your customers to pay you as soon as possible. With the ratio below, you’ll get the average number of days between billing and cashing. By calculating this ratio in number of days you can easily verify that your customers are meeting the expected payment deadline and you will also be able to act more easily on your reminders.

Use this ratio to manage your customer cashing time :

Renegotiate your supplier payment deadlines

This solution can sometimes be complicated, especially when your situation is already degraded. Anticipate and negotiate time-limits that are advantageous to you. The aim is of course to avoid the lag between the payment of your purchases and the cashing of your sales.

Calculate the supplier payment time with this ratio :

Be careful not to put your suppliers in trouble. You should not offload your cash problem to your business partners. If you put your suppliers under pressure, they may eventually let you go.

Use factoring

When your cash-in times are too long and you can’t optimize this time, or when you take too long to raise your customers, it may be worthwhile to use factoring. The principle is simple, you transfer your bills to an organization that will take care of the customer recovery for you and who will pay you your bills a few days after the transfer.

Before factoring, determine if the cost is a time saver, an organizational facility and a significant cash gain.

Of course, this service has a cost and you must first analyze the interest of factoring for your business in relation to its financial impact on your cash flow. But this solution will allow you to get out of a situation where you need immediate cash. You’ll also relieve your customer raise teams.

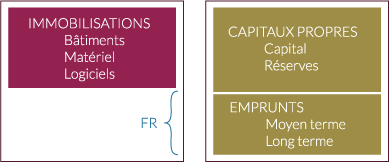

The working capital using BFR

The working capital or overall net working capital is another indicator of your financial health closely related to the BFR. The BFR focuses on your operating cycle and the FR focuses on long-term investments and capital to produce your business.

The FR measures the difference between your long-term capital (social capital, reserves, financial debts of more than one year…) and your assets (machines, software, buildings, etc.). This allows you to verify that your long-term resources are sufficient to finance your long-term assets.The FR must therefore be positive.

If it is negative, your company is underfunded and may soon be in financial difficulty. What for? The FR is used if it is positive to use the BFR. It is used to meet the cash needs due to your business. If it is large enough, it will even allow you to free up a surplus of cash.

Having a positive FR is therefore necessary to absorb your BFR. Otherwise, you are obliged to use external financing to finance your activity. But more seriously, you cannot finance all your production tools and buildings on your own.

The Practical Case: Fast Growth and BFR

Let’s take the example of a company in full development. It is growing and acquiring new markets and new customers and thus greatly increasing its turnover. At first glance, nothing is negative in this situation. However, this company is in financial difficulty and can no longer settle its suppliers. Why ?

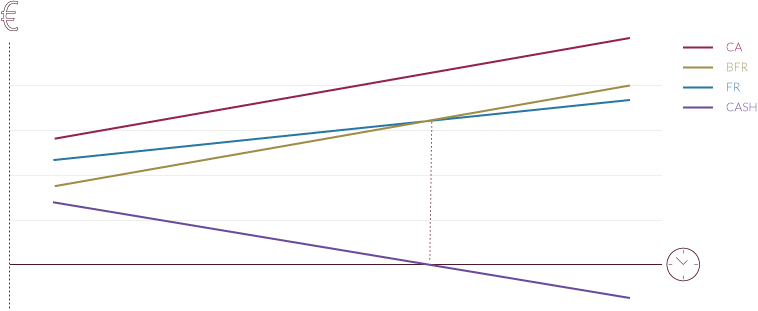

The graph illustrates the situation with a turnover that increases in the same way as the BFR. In this case, the FR is no longer able to fill the BFR and the cash level goes negative.

In order to meet these new markets, the company had to place significant new orders with its suppliers. Sometimes it has even had to find new suppliers for whom the terms of regulation may be less advantageous. It may also have hired more staff. Its cash outflows are therefore large and increasing. Its new customers, on the other hand, negotiated settlement terms later than its usual customers, thus widening the gap between supplier payment and customer settlement. These conditions thus increase the company’s BFR.

If nothing is done to fill this BFR, the cash can quickly become negative and lead the company to great difficulties (delays in payment suppliers, inability to settle its tax deadlines, …). In this situation, the company must monitor its BFR and its cash level and seek solutions quickly. It may try to negotiate more advantageous timeframes with its partners, obtain short-term financing solutions that will allow it to pay its suppliers, or factor in order to quickly collect payment of customer invoices.